Learn how low-income seniors can qualify for the Medicare Extra Help Program to pay less for prescriptions. Get the 2025 income limits, application steps, and savings you’re entitled to.

Read MoreMedicare Part D: What It Covers, How It Works, and What You Need to Know

When you're on Medicare Part D, the federal program that helps pay for prescription drugs for people enrolled in Medicare. It's not automatic—you have to sign up separately, and skipping it can cost you later. Also known as Medicare prescription drug coverage, it's designed to help you afford the medications you need without breaking the bank.

Medicare Part D isn’t one plan—it’s a network of private insurance plans approved by Medicare. Each plan has its own list of covered drugs, called a formulary, and each charges different monthly premiums, deductibles, and copays. Some plans cover more expensive drugs like insulin or cancer treatments, while others focus on common meds like blood pressure pills or diabetes drugs. The key is matching your prescriptions to the plan that covers them best. If you take Medicare Part D and don’t enroll when you’re first eligible, you could pay a late enrollment penalty forever—unless you had other creditable coverage, like from an employer.

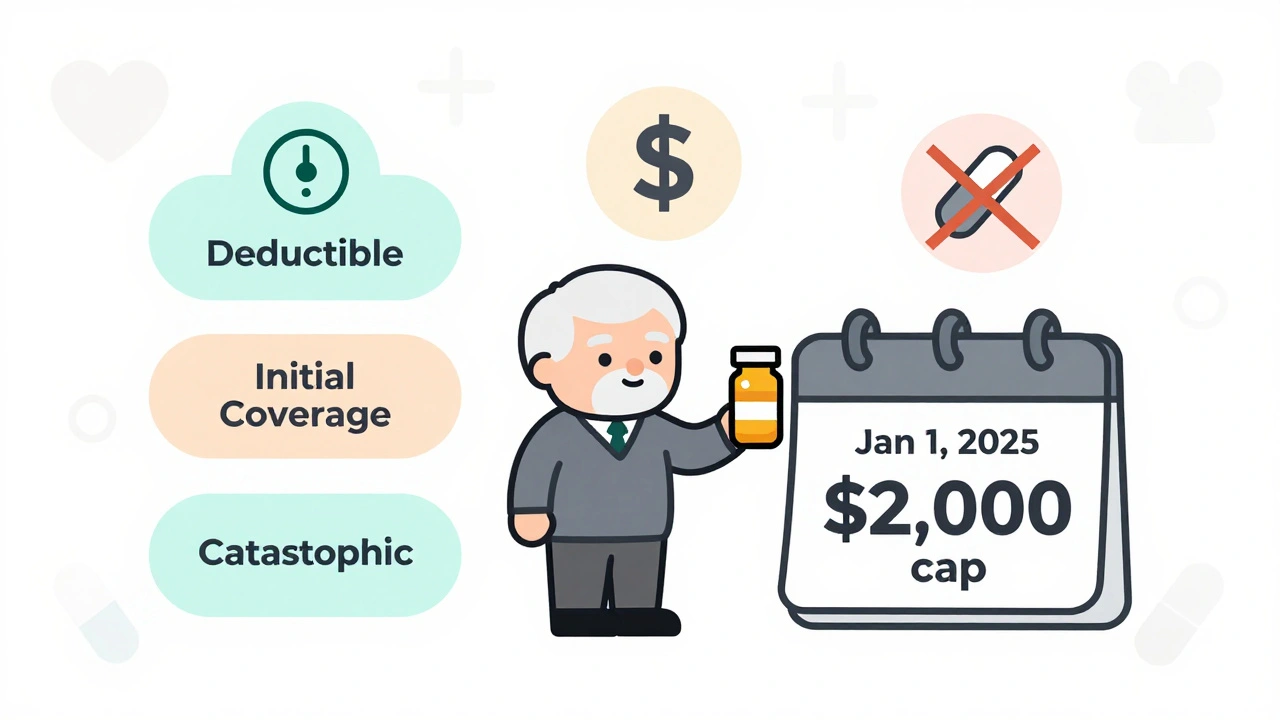

It’s not just about picking a plan. You also need to know how the coverage works inside the plan. There’s the initial coverage phase, then the donut hole—where you pay more out of pocket until you hit catastrophic coverage. That gap used to be brutal, but now discounts on brand-name and generic drugs help close it. Still, if you’re on a high-cost medication like Ozempic or Wegovy, even with discounts, you could be paying hundreds a month until you reach catastrophic protection. And don’t forget: not all pharmacies are equal. Some plans give you better prices at CVS or Walmart, while others push you toward mail-order. Check your plan’s pharmacy network before you enroll.

Medicare Part D also interacts with other parts of your health coverage. If you take thyroid meds like Synthroid, calcium supplements, or antibiotics like doxycycline, you need to time them right to avoid interactions—something your pharmacist can help with during a free medication review. And if you’re on insulin or GLP-1 agonists, your Part D plan might cover them, but only if they’re on the formulary. Some plans require prior authorization or step therapy before approving newer drugs. That’s why knowing your exact meds matters more than just picking the cheapest plan.

People often think Medicare Part D is simple because it’s federal—but it’s anything but. State rules don’t change it, but your income does. If you earn above a certain amount, you pay an extra monthly fee called IRMAA. And if you qualify for Extra Help (a low-income subsidy), you could pay almost nothing for your drugs. You don’t have to apply for Extra Help separately—it’s automatic if you get Medicaid or SSI. But if you’re unsure, ask your local State Health Insurance Assistance Program (SHIP). They’ll walk you through your options, no cost, no pressure.

Every year, plans change their costs, formularies, and pharmacy networks. That’s why open enrollment—from October 15 to December 7—isn’t just a reminder. It’s your chance to switch if your meds got more expensive, your favorite pharmacy dropped your plan, or a new drug came out that’s now covered. Don’t wait until you run out of pills. Review your plan now, compare your options, and make sure your coverage still fits your needs.

Below, you’ll find real-world guides on how to manage drug interactions, spot coverage gaps, and use your pharmacy’s consultation service to avoid mistakes. Whether you’re on thyroid meds, antibiotics, or weight-loss drugs like semaglutide, these posts help you navigate Medicare Part D with confidence—not confusion.

Medicare Part D in 2025 caps out-of-pocket drug costs at $2,000 annually, eliminating the donut hole. Learn how the new three-phase system works, how to pick the best plan, and what you still need to pay.

Read More