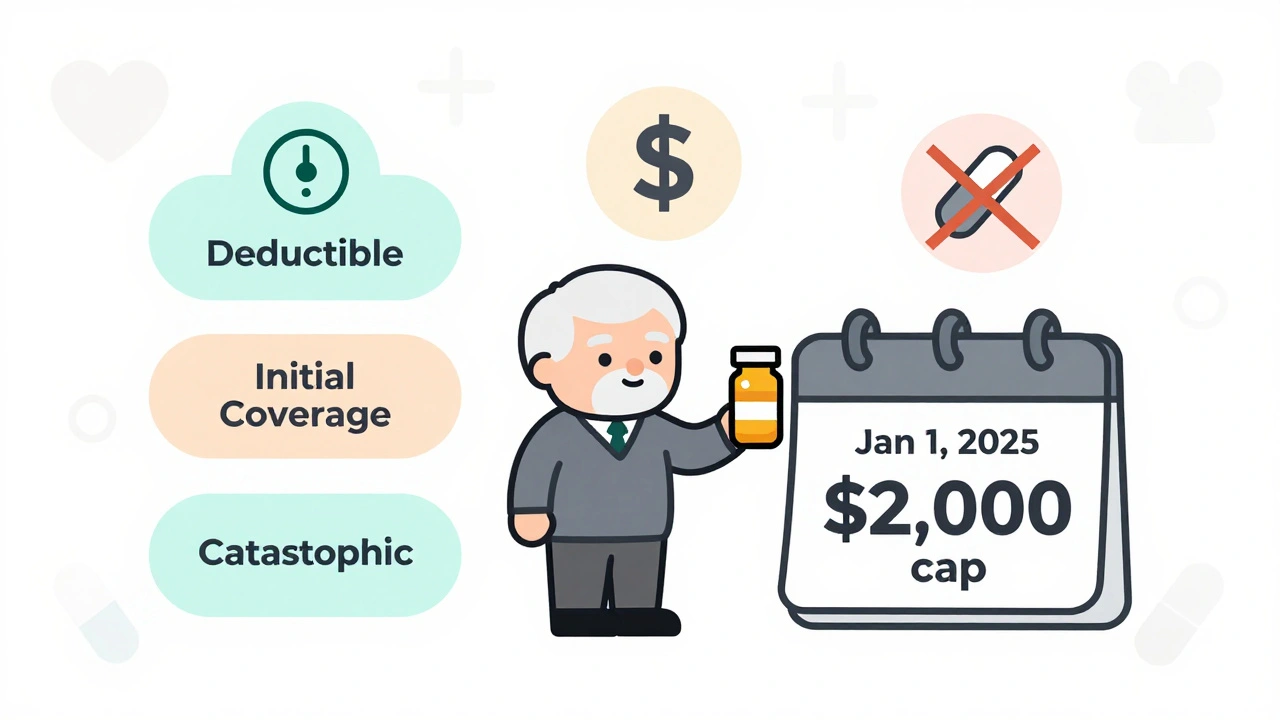

By 2025, Medicare Part D has changed more in the last two years than it has in the past two decades. If you’re on Medicare and take prescription drugs, you no longer have to worry about the confusing "donut hole" - it’s gone. Instead, there’s a simple, clear limit: you pay no more than $2,000 out of pocket for your medications each year. That’s it. After that, your drugs are free for the rest of the calendar year. This isn’t a promise. It’s the law - thanks to the Inflation Reduction Act of 2022, fully in effect as of January 1, 2025.

How Medicare Part D Works Now (2025)

Medicare Part D isn’t a single plan. It’s a network of private insurance plans approved by Medicare. These plans cover brand-name and generic drugs, and they’re offered either as stand-alone Prescription Drug Plans (PDPs) or bundled with Medicare Advantage (MA-PD). The big shift in 2025? A three-phase structure that’s easier to follow.

- Deductible Phase: You pay 100% of your drug costs until you hit the annual deductible. In 2025, that’s $590 - up slightly from $505 in 2024. Some plans have no deductible at all, especially if you qualify for Extra Help.

- Initial Coverage Phase: Once you’ve met your deductible, your plan pays most of the cost. You pay 25% of the price for each covered drug. This is where most people spend the bulk of their time. The plan pays 65%, manufacturers pay 10% through a discount program, and you pay the rest. This phase continues until your total out-of-pocket spending (including what you paid during the deductible) reaches $2,000.

- Catastrophic Coverage Phase: As soon as you hit $2,000, you’re done paying. For the rest of the year, you pay $0 for covered drugs. The plan pays 60%, manufacturers pay 20%, and Medicare pays 20%. No coinsurance. No copays. No surprises.

This is a massive improvement. Before 2025, beneficiaries could spend thousands more after hitting the coverage gap - sometimes paying 25%, then 37%, then 5% of drug costs. Now, it’s one clear number: $2,000. After that, you’re protected.

What You Still Pay: Premiums, Not Just Out-of-Pocket Costs

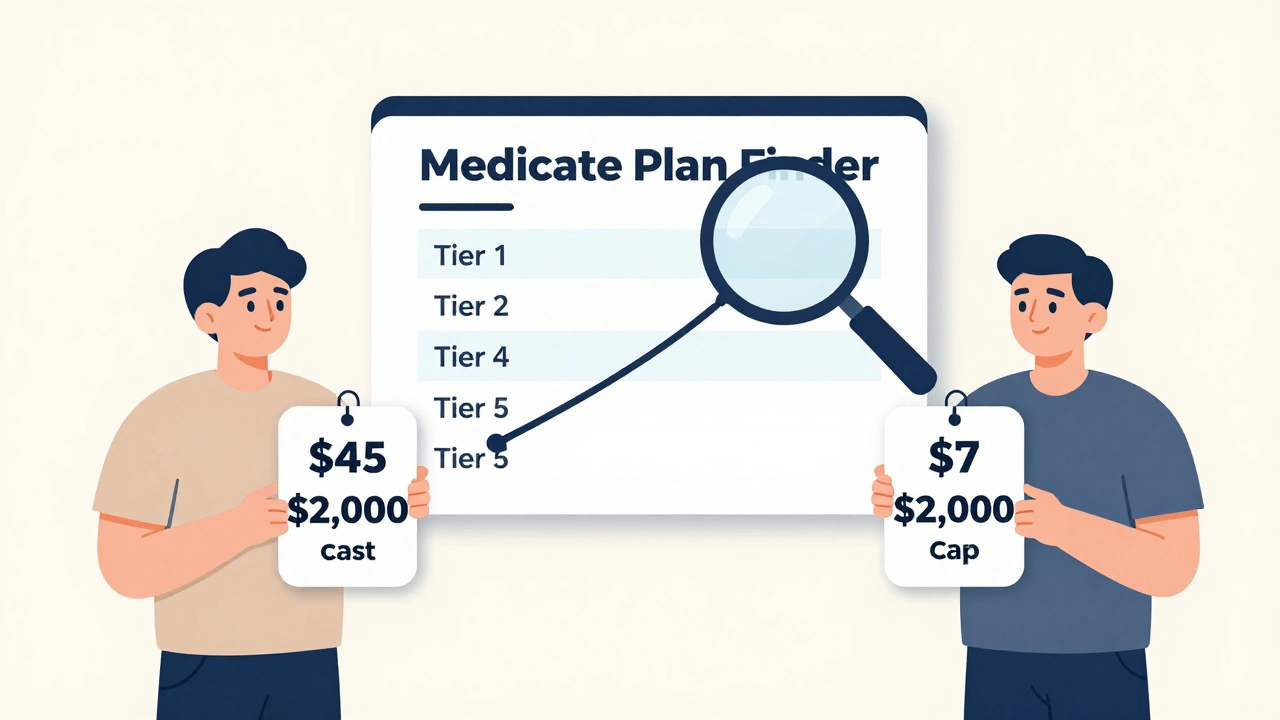

Many people get confused here. The $2,000 cap is only for what you pay for drugs - not your monthly premium. You still pay your plan’s monthly premium, no matter what. That’s separate. In 2025, the average premium for a stand-alone Part D plan is $45. For Medicare Advantage plans with drug coverage, it’s $7. That’s a huge difference.

So if you’re on a $45/month plan and take insulin, you’re paying $540 in premiums a year, plus up to $2,000 in drug costs. That’s $2,540 total. But you’re not paying $2,000 on top of your premium - you’re paying $2,000 for drugs, and your premium is extra. Always check both.

Here’s the good news: if your income is low, you might qualify for Extra Help - a federal program that cuts your premium, deductible, and copays. In 2025, 90 stand-alone Part D plans are available with $0 premiums to Extra Help enrollees. You still pay $0 for drugs after hitting the $2,000 cap, but your monthly bill drops even lower.

Insulin and Other Caps

The $35 monthly cap on insulin is still in place. If you take insulin, you pay $35 or less per prescription - no matter which plan you’re on. That cap applies even if you haven’t hit the $2,000 out-of-pocket limit yet. It’s one of the most popular parts of Part D.

Other drugs have similar protections. Certain vaccines, like shingles and flu shots, are covered with $0 cost-sharing. And starting in 2026, the out-of-pocket cap will rise to $2,100 - but only because it’s tied to inflation. The $2,000 cap was a fixed number for 2025 to give people breathing room.

Formularies and Tiers: The Hidden Trap

Even with the $2,000 cap, you can still get hit with high costs if your drug isn’t covered - or if it’s on a high tier. Most Part D plans use a five-tier system:

- Preferred Generic: Lowest cost - often $5 or less

- Generic: Slightly higher - $10 to $20

- Preferred Brand: $40 to $70

- Non-Preferred Brand: $80 to $150

- Specialty: $150+ - these are drugs for complex conditions like cancer or MS

Two plans might both cover your blood pressure medication - but one puts it on Tier 3, another on Tier 4. That’s a $100 difference per prescription. If you take multiple drugs, those costs add up fast. That’s why comparing plans isn’t optional - it’s critical.

How to Pick the Right Plan

Don’t just pick the cheapest premium. Pick the plan that covers your drugs at the lowest total cost. Here’s how:

- Make a list of every drug you take - including dosage and how often you take it.

- Go to the Medicare Plan Finder (it’s free, no login needed).

- Enter your drugs, zip code, and pharmacy preference.

- Look at the "Total Annual Cost" column - not just the premium.

- Check if your pharmacy is in-network. Some plans have better prices at CVS than Walgreens, or vice versa.

- Don’t forget to check if your plan covers the manufacturer discount for brand-name drugs.

You can do this in under 15 minutes. And you should do it every year during Open Enrollment - October 15 to December 7. Your plan can change its formulary, premiums, or pharmacy network at any time. What was cheap last year might be expensive this year.

What Happens If You Don’t Enroll?

If you don’t sign up for Part D when you’re first eligible - and you don’t have other creditable drug coverage - you’ll pay a late enrollment penalty. It’s 1% of the national base premium ($35.37 in 2024) for every month you wait. That penalty sticks with you for as long as you have Part D.

Example: You wait two years. That’s 24 months. 24 x 1% x $35.37 = $8.49 extra per month, forever. That’s over $100 a year - and it compounds every year. Even if you don’t take drugs now, a low-premium plan (some are under $10) is worth it just to avoid this penalty.

Who Can Help?

You don’t have to figure this out alone. State Health Insurance Assistance Programs (SHIPs) offer free, personalized counseling. They helped over 5 million people in 2023. Call 1-800-MEDICARE (1-800-633-4227) - they handled 78 million calls last year. You can also ask your pharmacist, your doctor’s office, or a local senior center.

And if you’re overwhelmed by the choices? You’re not alone. A 2024 survey by the Medicare Rights Center found that 68% of beneficiaries didn’t know about the 2025 changes. The system is simpler now - but the message hasn’t reached everyone yet.

What’s Next?

The $2,000 cap is just the start. In 2026, it rises to $2,100. By 2030, Part D spending is projected to hit $285 billion - mostly because of new, expensive drugs for rare diseases. But the redesign has already cut the number of beneficiaries facing catastrophic drug costs from 15% to under 2%. That’s millions of people who won’t have to choose between buying medicine and paying rent.

The system isn’t perfect. Drug list prices are still too high. Some plans still have narrow networks. But for the first time since Part D began, people can plan. They know what they’ll pay. And that’s worth more than any premium savings.

Does Medicare Part D cover all my medications?

No. Each Part D plan has its own list of covered drugs, called a formulary. Plans must cover at least two drugs in each class, but they can choose which ones. Always check if your specific drugs are covered and on what tier. Specialty drugs like those for cancer or MS often have higher cost-sharing.

I’m on a $0 premium Part D plan. Why do I still pay for my drugs?

A $0 premium means you don’t pay a monthly fee to the plan. But you still pay your share of drug costs during the deductible and initial coverage phases - until you hit the $2,000 out-of-pocket cap. These plans often have higher copays or coinsurance, so your total drug cost might still be high before you reach the cap.

Is the $2,000 cap per person or per household?

It’s per person. Each Medicare beneficiary has their own $2,000 out-of-pocket limit. If you and your spouse both have Part D, you each have your own cap. Your spending doesn’t combine with your spouse’s.

Do I have to re-enroll every year?

No, you’re automatically renewed - but that doesn’t mean you should stay. Plans change their premiums, formularies, and pharmacy networks every year. Even if you’re happy with your plan, check the Medicare Plan Finder each year during Open Enrollment (October 15-December 7). You might find a better deal.

What if I can’t afford my drugs even after the $2,000 cap?

If you’re still struggling, ask about Extra Help - a federal program for low-income beneficiaries. It reduces premiums, deductibles, and copays. You can also ask your doctor about generic alternatives or patient assistance programs from drug manufacturers. Many pharmaceutical companies offer free or discounted drugs to people who qualify.

11 Comments

Finally something that makes sense. I was paying $800 a month for my diabetes meds last year. Now I know I won't hit that wall. Life's a little less scary.

This is huge. I've been helping my mom navigate Part D for years and she cried when she saw the new cap. No more choosing between insulin and groceries. Thank you to whoever made this happen.

It's not perfect but it's progress. We've been talking about this for decades. Sometimes the system works when people stop fighting it and just fix what's broken.

People still don't get it. The $2,000 cap is only for out-of-pocket drug costs. Premiums are separate. I've seen seniors sign up for $0 premium plans thinking they're getting free drugs. They're not. They're just paying more upfront per pill. It's not magic, it's math. And math still matters.

So the government now decides how much you can spend on medicine but not how much drug companies can charge. The real problem is the manufacturers jacking up prices then letting the government take the blame for capping what patients pay. This is theater not reform. And the $35 insulin cap? That was always a political stunt. The real cost of insulin hasn't dropped. Only the sticker price did. You're still paying for it through taxes and premiums. This is a bait and switch disguised as compassion

They say the donut hole is gone but did you know the same people who wrote this law also pushed for AI drug approval? They're letting algorithms decide what drugs you get. And your pharmacy data? It's going to a private contractor that also owns stock in Big Pharma. You think this is about saving money? It's about control. You're being tracked. You're being managed. The $2,000 cap is just the candy coating on a poison pill

they say its $2000 but wait till u see ur formulary. my antidep was moved to tier 5 and now its $120 a pill. they call it a cap but its a trap. and dont get me started on how they changed the pharmacy network. now i have to drive 45 mins to get my meds. and they wonder why people are mad

Oh wow the government finally did something right. I guess we can all stop complaining now. The only thing more ridiculous than this policy is the people who think it's a victory. The real cost of drugs hasn't changed. We're just pretending the problem is solved so we don't have to fix the real issue. This isn't reform. It's a PR stunt for voters who don't read the fine print

I used to work at a community pharmacy. I saw people crying because they couldn't afford their heart meds. I saw people skipping doses. I saw people choosing between rent and refills. This $2,000 cap? It’s not just a number. It’s the difference between someone living and someone dying. I’ve been in this game for 22 years. I’ve seen a lot of empty promises. This one? This one actually works. I’ve seen it. I’ve watched my patients breathe easier. Don’t let the cynics dim this light. It’s real.

As someone from India where drug pricing is a daily struggle, I see this as a rare moment of sanity in global healthcare policy. The structure is elegant - simple thresholds, transparent phases, no hidden cliffs. It doesn’t fix everything, but it gives dignity back to the patient. No more guessing. No more panic. Just a clear line you don’t cross. That’s not policy. That’s humanity.

Let us not be fooled by this performative legislative gesture masquerading as progress. The Inflation Reduction Act of 2022 was not born of altruism but of political expediency - a calculated maneuver to appease the aging demographic bloc before the next election cycle. The $2,000 cap? A cosmetic veneer applied over a system still riddled with monopolistic pricing structures, opaque formulary tiers, and pharmacy benefit managers who extract billions in rebates while patients hemorrhage dignity. The real villain is not the pharmaceutical industry - it is the institutional inertia that permits such a fragile, politically contingent framework to pass for reform. And let us not forget: the cap is temporary, inflation-adjusted, and subject to future legislative whim. This is not security. This is a loan from a very fickle creditor. We are not free. We are merely on probation.