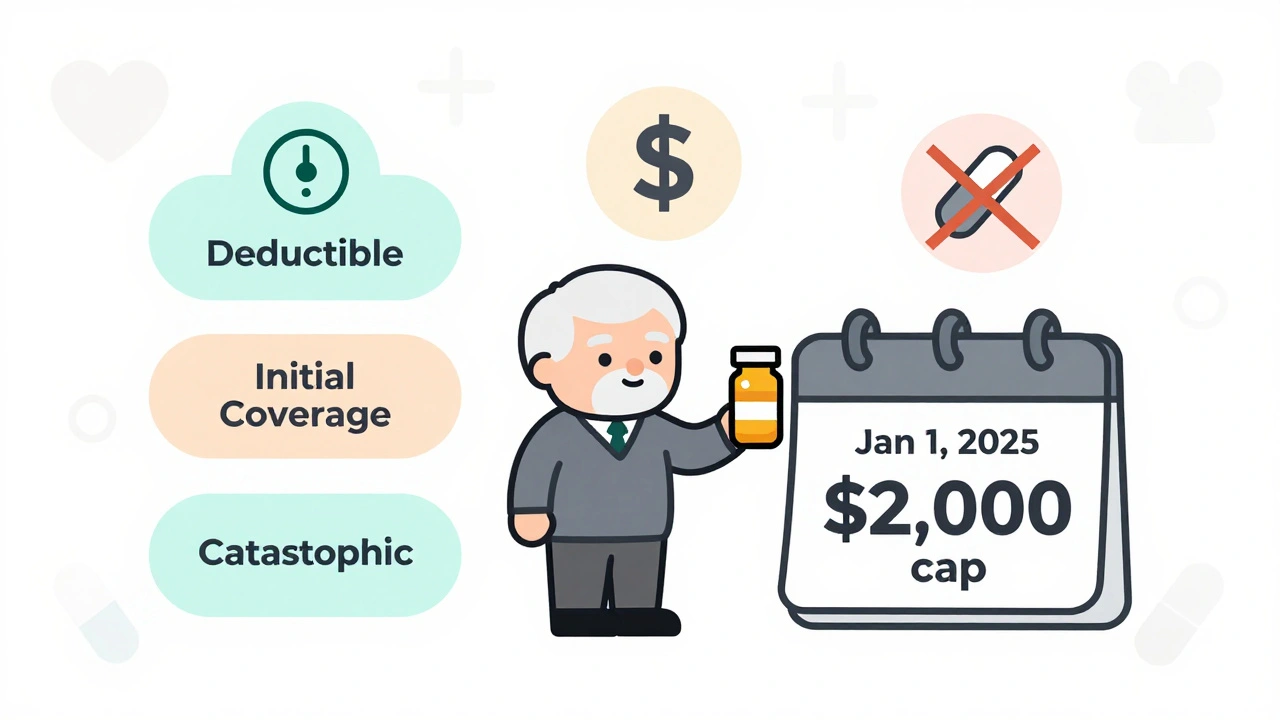

Medicare Part D in 2025 caps out-of-pocket drug costs at $2,000 annually, eliminating the donut hole. Learn how the new three-phase system works, how to pick the best plan, and what you still need to pay.

Read MorePrescription Drug Coverage: What It Includes and How to Get the Most Out of It

When you hear prescription drug coverage, the part of your health insurance that pays for medications prescribed by a doctor. Also known as pharmacy benefits, it’s not just about whether your pills are covered—it’s about how much you pay, when you pay it, and whether your plan even lets you get them at all. Many people assume if a drug is FDA-approved, their insurance will cover it. That’s not true. Your plan has a formulary, a list of drugs your insurer agrees to pay for, sorted into tiers based on cost and preference. Tier 1 might be generic painkillers you pay $5 for. Tier 4 could be a specialty drug for diabetes that costs $500 a month—even with insurance. The difference between tiers isn’t about effectiveness. It’s about money. And your plan’s formulary changes every year, often without warning.

Prior authorization, a requirement that your doctor proves a drug is medically necessary before the insurer will pay. You might get prescribed a drug your doctor swears is best—only to find out your plan won’t touch it unless your doctor fills out five forms, sends lab results, and waits three weeks. This isn’t bureaucracy for fun. It’s a cost-control tactic. But it delays treatment. And for people managing chronic conditions like thyroid disease, diabetes, or mental health disorders, delays can mean hospital visits, worse symptoms, or even life-threatening complications. Then there’s step therapy, a rule that forces you to try cheaper drugs first, even if they didn’t work before. Your doctor says Zoloft helped you for years? Your plan says try a different SSRI first. Why? Because it’s cheaper. Not because it’s better.

And don’t forget about coverage gaps. The Medicare Part D doughnut hole is the most famous, but private insurers have their own versions. You might hit a limit where you pay 100% out of pocket until you spend a certain amount. That’s when people skip doses, split pills, or stop taking meds altogether. A 2023 study found nearly 1 in 4 Americans with chronic conditions cut back on prescriptions because of cost. That’s not a choice. It’s a crisis.

But you’re not powerless. You can ask your pharmacist to check your plan’s formulary before you fill a script. You can appeal a denial. You can switch plans during open enrollment. You can use patient assistance programs from drugmakers. And you can push back when your doctor says, "That’s what your insurance allows." Because sometimes, it doesn’t have to be.

The posts below dive into real-world examples of how drug interactions, timing, and insurance rules collide. You’ll find stories about how calcium supplements block thyroid meds, how dairy ruins antibiotics, and how even your morning juice can mess with your treatment. These aren’t edge cases. They’re everyday problems that turn into emergencies when coverage is unclear or denied. Whether you’re managing high cholesterol, diabetes, or mental health, knowing how your prescription drug coverage works isn’t optional—it’s your first line of defense.