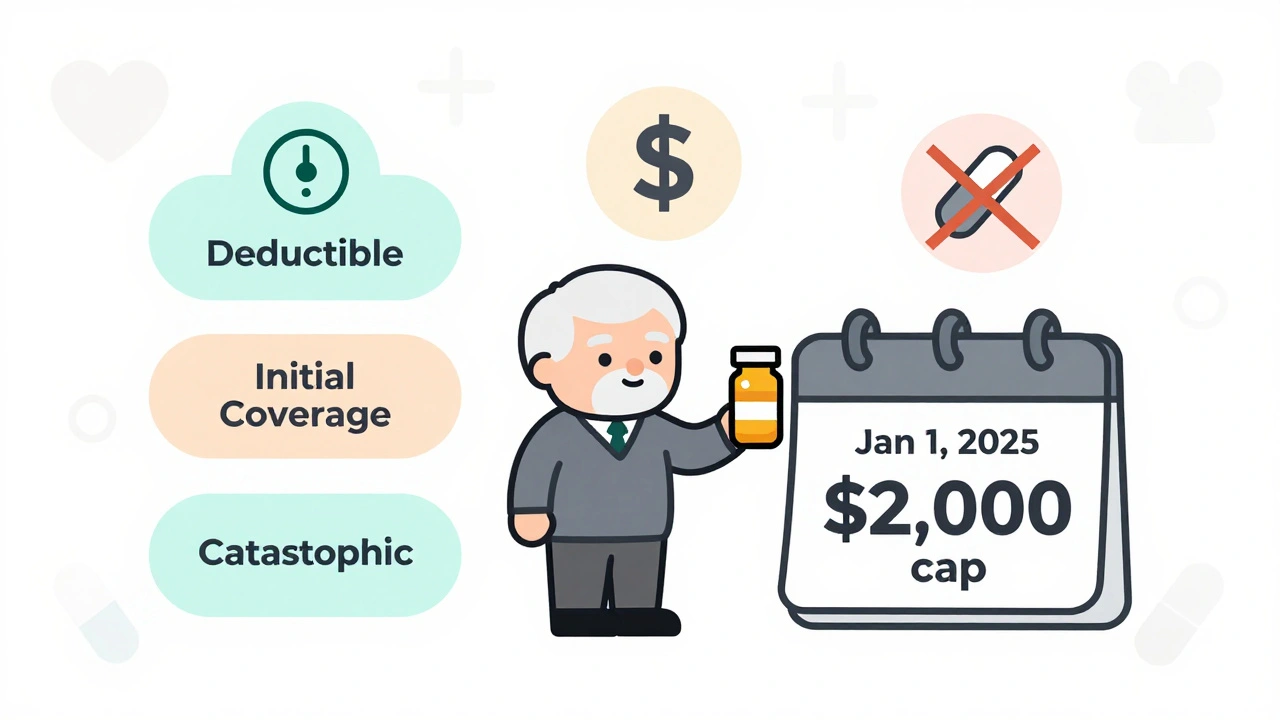

Medicare Part D in 2025 caps out-of-pocket drug costs at $2,000 annually, eliminating the donut hole. Learn how the new three-phase system works, how to pick the best plan, and what you still need to pay.

Read MorePart D 2025 Changes: What You Need to Know About Medicare Drug Plan Updates

When it comes to Part D 2025 changes, the annual updates to Medicare’s prescription drug coverage that directly impact what you pay for medications. Also known as Medicare Part D, it’s the part of Medicare that helps cover the cost of prescription drugs, and every year, the rules shift—sometimes in ways that save you hundreds. The 2025 updates aren’t just fine print. They’re real changes that lower your monthly bills, cap your spending, and make it easier to get the drugs you need without surprise costs.

One of the biggest shifts is the new out-of-pocket cost cap, a limit on how much you pay each year for your prescriptions before your plan covers 100%. Also known as catastrophic coverage threshold, it’s now set at $2,000 in 2025—down from over $7,000 just a few years ago. That means if you take multiple high-cost meds, you won’t be stuck paying thousands just to keep your treatment going. Another major change is the insulin cost cap, which limits your monthly payment to $35 for each prescription, no matter your plan or income. This rule now applies to all Part D plans, so even if you’re on a basic plan, you’re protected.

These changes don’t just help people with diabetes. They’re part of a broader push to make drug pricing more predictable. The drug price negotiation program, a new federal effort that lets Medicare haggle directly with drugmakers for lower prices on select high-cost drugs. Also known as Medicare Drug Price Negotiation, it’s starting with 10 drugs in 2025 and will grow over time. If you take one of these meds—like Eliquis, Jardiance, or Xarelto—you could see big drops in your co-pay. And for the first time, plans must show you real-time cost estimates when you fill a prescription, so you know what you’re paying before you leave the pharmacy.

But it’s not all good news. Some plans may raise premiums or narrow their formularies to balance these new costs. You might find your current drug isn’t covered the same way next year, or your pharmacy network shrinks. That’s why checking your plan’s annual notice of changes—usually mailed in October—is more important than ever. Don’t assume your coverage stays the same. Even small tweaks to tier placement or prior authorization rules can add up.

These updates tie directly into the real-world issues you’ve seen in posts about medication interactions, insulin management, and drug pricing. Whether you’re managing thyroid meds, diabetes drugs, or long-term antibiotics, the way your Part D plan works affects your entire treatment plan. The posts below break down how these changes impact specific meds, what to ask your pharmacist, and how to avoid coverage gaps that could leave you paying more—or going without.