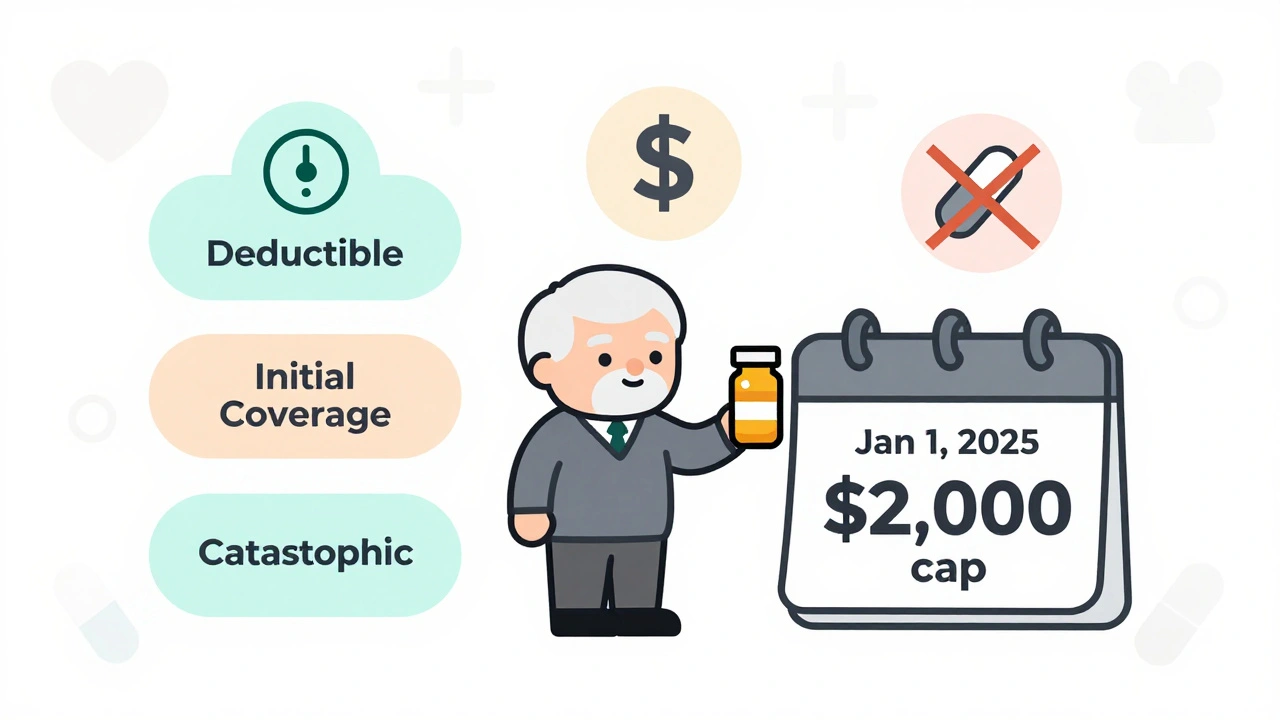

Medicare Part D in 2025 caps out-of-pocket drug costs at $2,000 annually, eliminating the donut hole. Learn how the new three-phase system works, how to pick the best plan, and what you still need to pay.

Read MoreMedicare Drug Costs: What You Pay and How to Reduce Them

When you're on Medicare, a U.S. federal health insurance program for people 65 and older or with certain disabilities. Also known as Original Medicare, it covers hospital and doctor visits—but not all drugs. That’s where Medicare Part D, the prescription drug coverage component of Medicare offered through private insurers. It's required to get drug discounts and avoid late enrollment penalties. comes in. Without it, you’re paying full price for everything from insulin to blood pressure pills. And that price? It can jump from $10 to $500 a month depending on your plan, where you live, and even the pharmacy you use.

Many people think Medicare Part D is straightforward, but it’s not. There’s the monthly premium, the deductible (some plans have $0, others up to $505 in 2024), then coinsurance or copays. Then comes the coverage gap—what’s called the "donut hole." Once you and your plan spend a certain amount on drugs ($5,030 in 2024), you pay 25% of the cost for brand-name and generic drugs until you hit the catastrophic coverage threshold. After that, you pay either 5% of the cost or a small copay, whichever is higher. This system isn’t broken—it’s designed to shift costs between you, your plan, and drug makers. But that doesn’t make it easy to understand.

What makes it worse? Some drugs cost more in the U.S. than anywhere else. A month of Ozempic might be $1,000 here but $150 in Canada. And even if you’re on a low-income subsidy, you still need to pick the right plan each year. Plans change their formularies, networks, and prices every January. A plan that saved you $200 last year might cost $300 more this year because your favorite medication got moved to a higher tier. That’s why checking your plan every fall during Open Enrollment isn’t optional—it’s essential.

You can lower your costs by switching to generics, using mail-order pharmacies, or asking your doctor for a 90-day supply. Some drug manufacturers offer patient assistance programs that cut prices by 80% or more. And if you’re struggling, you might qualify for Extra Help—a federal program that reduces premiums, deductibles, and copays. It’s not hard to apply, but most people don’t know it exists.

There’s also the issue of drug tiers. Your plan puts medications into levels—Tier 1 for cheap generics, Tier 5 for expensive specialty drugs. If your thyroid medicine is on Tier 3 instead of Tier 1, you’re paying three times more. And if your plan drops a drug from its formulary, you might have to switch meds mid-treatment. That’s why knowing your plan’s formulary before you sign up matters more than the monthly premium.

And don’t ignore pharmacy networks. A drug might cost $20 at CVS but $65 at Walgreens—even with the same plan. Some plans only cover certain pharmacies, or charge more if you use an out-of-network one. You might save $150 a month just by switching to a different pharmacy.

What you’ll find below are real, practical guides from people who’ve been through this. How to compare Part D plans without getting lost in fine print. How to appeal a drug denial. Why some Medicare Advantage plans bundle drug coverage—and when they don’t save you anything. How to use the Medicare Plan Finder tool correctly. And what to do when your insulin bill still breaks your budget, even with coverage.