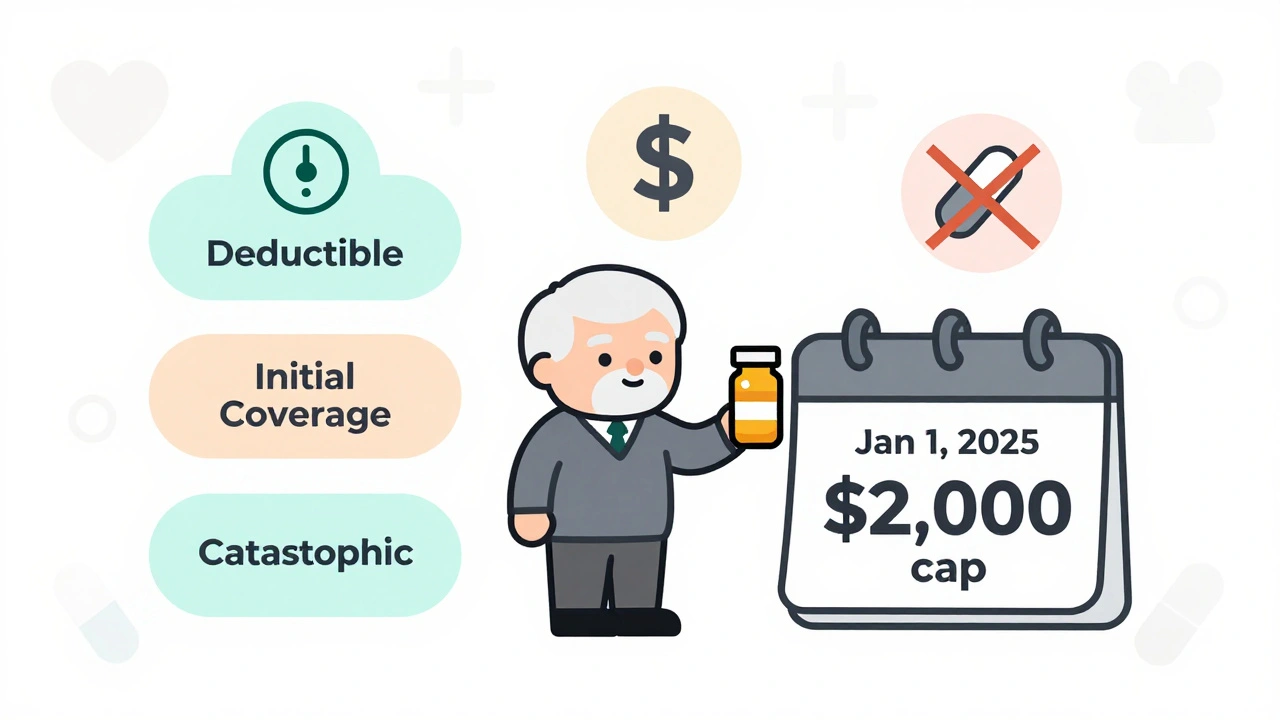

Medicare Part D in 2025 caps out-of-pocket drug costs at $2,000 annually, eliminating the donut hole. Learn how the new three-phase system works, how to pick the best plan, and what you still need to pay.

Read MorePart D Out-of-Pocket Cap: What It Means for Your Medicare Drug Costs

When you’re on Medicare Part D, the prescription drug coverage plan for people enrolled in Medicare. Also known as Medicare drug plan, it helps cover the cost of medications—but without limits, your expenses could spiral. That’s where the Part D out-of-pocket cap, the maximum amount you pay annually for covered drugs before your plan pays 100%. This cap, fully in effect since 2025, stops runaway drug costs and gives people with chronic conditions real financial relief.

Before the cap, some seniors paid thousands each year just to keep their medications. Now, once you hit $2,000 in out-of-pocket spending, your plan covers nearly everything left for the rest of the year. It doesn’t matter if you’re on insulin, heart meds, or cancer drugs—the cap applies across the board. But here’s what most people miss: the cap only kicks in after you’ve paid your deductible, coinsurance, and copays. If you’re on a high-deductible plan, you might hit that $2,000 faster than you think. And while the cap protects you from sky-high bills, it doesn’t mean your premiums dropped. You still need to watch both your monthly cost and your spending total.

The Part D out-of-pocket cap, a major change to Medicare’s drug benefit structure. Also known as catastrophic coverage threshold, was built to fix a broken system. Before, people with complex conditions often skipped doses or split pills just to stretch their budget. Now, with the cap, that kind of sacrifice shouldn’t be necessary. But it only works if you’re enrolled in a plan that follows the new rules. Not all Part D plans are the same—some have lower premiums but higher out-of-pocket costs early in the year. That’s why knowing your plan’s structure matters more than ever.

And it’s not just about the cap itself. The cap interacts with other parts of your coverage. If you get Extra Help (Low-Income Subsidy), your out-of-pocket costs are already capped lower. If you use mail-order pharmacies, your spending still counts toward the cap. And if you switch plans mid-year, your spending carries over—but only if you stay in the same plan type. The system is designed to be fair, but it’s not simple. You need to track your spending, know your plan’s formulary, and understand how your pharmacy choices affect your total.

What you’ll find in the articles below are real stories and clear breakdowns of how people manage their drug costs under Medicare. You’ll see how calcium and iron supplements can interfere with thyroid meds, why dairy can block antibiotics, and how GLP-1 agonists like Ozempic are changing treatment—but also how much they cost. You’ll learn how to time your meds to avoid interactions, how to use your pharmacist’s consultation service to catch hidden costs, and how to spot when a generic drug might be failing you. These aren’t abstract rules—they’re daily realities for people managing chronic conditions, and they all tie back to one thing: keeping your meds affordable and effective.