When you fill a prescription for a generic drug, what you pay can depend on which side of the border you live on. In Canada, a 90-day supply of generic atorvastatin might cost you $45. In the U.S., the same dose from a mail-order pharmacy could be $12. That’s not a mistake. It’s the result of two completely different systems designed to do the same thing: get affordable medicines to patients. But they go about it in opposite ways.

Canada’s System: Centralized Control, Slower Prices

Canada doesn’t let drug prices float freely. Instead, it uses a coordinated approach through the pan-Canadian Pharmaceutical Alliance (pCPA) a group of provincial and territorial governments that negotiate drug prices collectively for public drug plans. Since 2010, the pCPA has been negotiating prices for generic drugs on behalf of all public insurers. This means when a brand-name drug loses its patent, the government doesn’t wait for competition to drive prices down - it steps in and sets a maximum price before generics even hit the shelves.

The result? Generic drug prices drop, but slowly. It can take 18 to 24 months after a patent expires for the lowest price to be locked in. That’s because every province has to agree on the price, and negotiations happen one drug at a time. The system is designed to avoid price spikes and ensure steady access, not to create a race to the bottom.

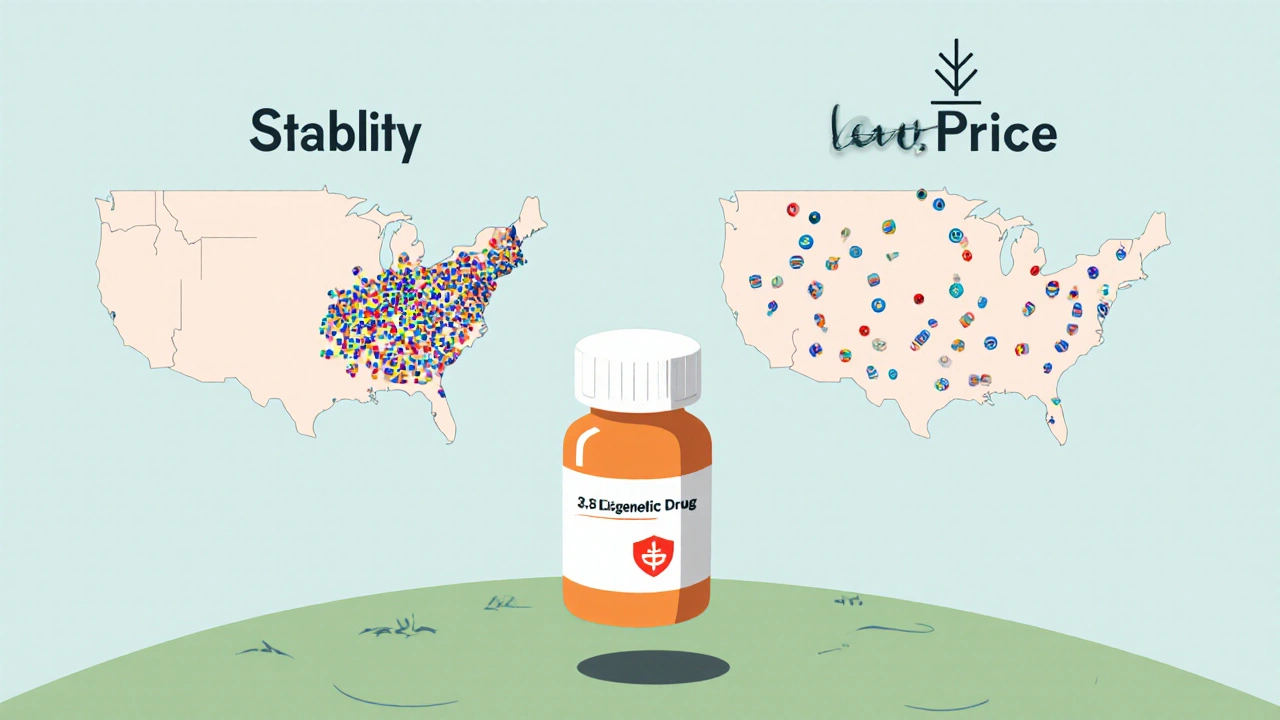

But here’s the twist: while Canada controls brand-name drug prices tightly through the Patented Medicine Prices Review Board (PMPRB) a federal agency that sets price caps for patented drugs to prevent excessive pricing, it has no authority over generic drug prices. That means manufacturers of non-patented drugs can charge what they want - and often do. With fewer competitors in Canada’s smaller market, there’s less pressure to cut prices. The average generic drug in Canada has just 3.8 manufacturers competing for sales. In the U.S., it’s 7.3.

The U.S. System: Free Market, Fast Drops, But Chaos Too

The U.S. has no national price control for any drug - brand or generic. When a patent expires, any company can make the generic. The first one to file gets 180 days of exclusive rights. Then the floodgates open. Dozens of manufacturers jump in. Prices crash - often by 80% to 90% within six months.

That’s why a U.S. pharmacy might sell a generic version of metformin for $4. But it also means prices vary wildly. One pharmacy charges $8. Another, across town, charges $22. That’s why 63% of Americans have to check three or more pharmacies to find the best deal. Tools like GoodRx help, but they’re a band-aid on a broken system.

The upside? Lower prices. The downside? Unstable supply. When a drug has only one or two makers, and one factory has a quality issue, the whole country can run out. In 2022, the U.S. saw a major shortage of albuterol inhalers. Hospitals in Seattle waited weeks. Meanwhile, in Calgary, Health Canada stepped in, rerouted supplies, and kept the drug available. That’s because Canada tracks shortages in real time and intervenes early. The U.S. FDA reacts - Canada anticipates.

Why Are Canadian Generic Prices Sometimes Higher?

It sounds backwards, but it’s true. For some generics, you’ll pay more in Canada than in the U.S. According to PharmacyChecker’s 2023 study, 88% of the top 34 prescribed generics were cheaper in the U.S. But that doesn’t mean Canada’s system is failing. It means it’s trading lower prices for stability.

Canada’s smaller population - just 40 million compared to 330 million in the U.S. - means fewer manufacturers want to enter the market. Setting up a distribution network, getting regulatory approval, and negotiating with 13 different provincial plans isn’t worth it for a small profit margin. So fewer companies compete. And when competition is low, prices stay higher.

Meanwhile, U.S. manufacturers can sell to thousands of pharmacies, insurers, and mail-order services. The scale is massive. That’s why they can afford to sell at pennies on the dollar. But they also walk away if the profit isn’t there. That’s why some generics disappear from U.S. shelves entirely.

Who Gets Hit the Hardest?

In Canada, patients with private insurance often pay less because their plans are tied to the pCPA’s negotiated prices. Public plans cover 42% of outpatient drug spending, private plans cover the rest. Most Canadians have some form of coverage - 67% - so even if a drug is expensive, someone else is paying most of it.

In the U.S., 54% of people have private insurance, but those plans often have high deductibles and copays. A patient might pay $50 out-of-pocket for a generic even if the pharmacy’s list price is $10. Without insurance, the cost can be brutal. That’s why 1 in 5 Americans skip doses because they can’t afford their meds.

But here’s the real difference: when a drug goes into shortage, Canadians are more likely to get it. In a 2023 survey, 68% of Canadian patients reported no access issues with essential generics. In the U.S., only 49% said the same. That’s because Canada’s system forces manufacturers to report potential shortages early. Health Canada works with them to find alternatives, boost production, or bring in imports - before patients are left without.

What About the Bigger Picture?

Canada spends $814 per person on prescription drugs each year. The U.S. spends $1,432. That’s a 43% difference. Even though Canadians pay more for some generics, they pay far less overall. Why? Because Canada controls the prices of the most expensive drugs - the brand-name ones. And because it negotiates in bulk, it avoids the wild price swings that plague the U.S. system.

Canada also gets more value from its generics. Even though only 83% of prescriptions filled are for generics (compared to 90% in the U.S.), they saved the Canadian healthcare system over $37 billion in a single year. That’s not just money saved - it’s money kept in the system for other care: mental health, cancer treatment, diabetes management.

The U.S. saves money on generics, but it pays for it in other ways: emergency room visits due to skipped doses, hospitalizations from uncontrolled conditions, and the cost of managing drug shortages. One study found the U.S. had more than double the risk of shortages for sole-sourced drugs than Canada.

What’s Next?

Canada is under pressure. The pCPA’s latest pricing agreement, effective October 2023, is designed to keep costs down. But supply chain issues, inflation, and rising manufacturing costs are pushing prices up. Experts predict a 15-20% increase in generic prices by 2025.

The U.S. is watching. Several states - Vermont, Colorado, Florida - have passed laws to import drugs from Canada. But the federal government won’t allow it. Why? Because they fear it will strain Canada’s supply. And Canada has already responded by tightening its own supply chain rules to protect its patients.

There’s no perfect system. The U.S. wins on price, but loses on reliability. Canada wins on stability, but loses on cost for some drugs. The real question isn’t which is better - it’s what you value more: lower prices today, or consistent access tomorrow.

Why are generic drugs more expensive in Canada than in the U.S.?

Canada doesn’t have the same level of competition as the U.S. Because it has a smaller population, fewer manufacturers enter the market. With only about 3.8 companies making each generic drug, there’s less pressure to lower prices. In the U.S., dozens of manufacturers compete, driving prices down quickly. Canada also negotiates prices slowly through its provincial alliance, which delays price drops after patents expire.

Does Canada have drug shortages like the U.S.?

Yes, but less often - and they’re managed better. Canada tracks potential shortages in real time and steps in early to prevent them. Health Canada works with manufacturers to find alternatives or boost production. In the U.S., shortages are often only addressed after they’ve already happened. Studies show the risk of a shortage for sole-sourced drugs is more than double in the U.S. compared to Canada.

Do Canadians pay more for all generic drugs?

No. While many common generics are cheaper in the U.S., not all are. Some Canadian prices are similar, and a few are even lower. The difference depends on the drug, the manufacturer, and whether it’s sold through public or private plans. But overall, for the most commonly prescribed generics, U.S. prices are lower - often by 60% or more.

How does Canada keep drug costs down overall?

Canada controls the prices of brand-name drugs through the Patented Medicine Prices Review Board (PMPRB), which sets strict price caps. It also negotiates bulk prices for generics through the pan-Canadian Pharmaceutical Alliance (pCPA). Even though some generics cost more, the savings on expensive brand-name drugs and the efficiency of centralized buying bring the total per-person cost down significantly compared to the U.S.

Can Americans buy drugs from Canada legally?

Technically, importing drugs from Canada is against U.S. federal law. But some states have passed laws allowing it under strict conditions. The federal government has never approved a nationwide program. Canada has also tightened its own rules to prevent its supply from being drained by U.S. buyers. So while it’s possible to order from Canadian pharmacies online, it’s not officially sanctioned or guaranteed to be safe.

Final Thought: It’s Not About Cheaper - It’s About Reliable

If your priority is paying the lowest price possible for a generic pill, the U.S. wins. But if you care about whether that pill will be there next month - when your condition doesn’t wait - Canada’s system has the edge. One country bets on competition. The other bets on coordination. One gives you lower prices today. The other gives you peace of mind tomorrow.

14 Comments

Canada's system isn't about cheap pills it's about not waking up one day and finding your life-saving med gone

The U.S. system prioritizes market efficiency over patient security. This isn't capitalism-it's chaos with a pharmacy receipt.

Oh, so Canada's 'stability' is just government-enforced mediocrity? And we're the villains for having competition? I'm sorry, but if a drug costs $12, why should I pay $45 because some bureaucrat thinks 'predictability' is a virtue? This is socialism with a side of insulin.

Let me tell you something-Canada's system is like a slow-cooked stew while the U.S. is a deep-fried tornado of pills. One keeps you full, the other just makes your wallet cry and your stomach churn. I've had my albuterol vanish three times in two years. Three times. I had to beg at three pharmacies, cry to my nurse, and finally buy it from a sketchy website that didn't ask for my Social. That's not freedom. That's trauma with a barcode.

Canada's system is a failure disguised as compassion. They can't even compete with our market? Pathetic. We have innovation, they have bureaucracy. We have choice, they have rationing. We have 7.3 manufacturers-they have 3.8 and call it 'stability.' That's not healthcare, that's surrender. And now they're scared we'll buy their drugs? Good. Let them feel the pain of real competition.

Here in South Africa, we know what it means to wait for medicine. Canada’s system, flawed as it may seem, is a quiet act of dignity. To have a government that says 'you will not be left behind'-even if the pill costs a little more-is not weakness. It is the opposite of colonial neglect. The U.S. system screams 'buyer beware' while Canada whispers 'we’ve got you.' And sometimes, that whisper saves lives.

bro canada’s system is just lazy capitalism. why not let 20 companies fight for the same drug? then price drops fast. u.s. has 7.3 makers, canada has 3.8. that’s not stability, that’s cartel vibes. also why do u think u pay less in usa? cuz big pharma can’t stop competition. in canada, they just chill and wait for govt to say 'ok, $45 now'

Hey everyone, I just want to say this: Canada's system might not be flashy, but it's reliable. I’ve seen friends in the U.S. skip doses because they couldn’t afford their meds. That’s not freedom. That’s suffering. Canada’s way isn’t perfect, but it’s built on care, not competition. And that matters more than a few dollars saved today.

Let’s be real: this is all part of the Globalist Pharma Cartel’s master plan. Canada’s 'pCPA' is just a front for the WHO’s Agenda 2030 to control your medication supply. The U.S. is being sabotaged so they can force everyone into a single-payer system under the guise of 'stability.' And now they’re afraid Americans will buy Canadian drugs? Of course they are-because if we find out we’ve been lied to about prices, the whole house of cards collapses. 🌍💊 #DeepStatePharma

Canada's system is a masterclass in economic self-sabotage. They don't want competition because they're afraid of losing control. The fact that 88% of generics are cheaper in the U.S. isn't a flaw-it's proof their system is broken. And now they're hoarding drugs like they're gold bars? Classic. They don't care about patients-they care about control. The U.S. may be chaotic, but at least it's honest about the cost of freedom.

Interesting how both systems have trade-offs. I think the real issue is that we don’t talk about this enough. People assume one side is 'better,' but the truth is messy. Maybe we need a hybrid-bulk negotiation for essential meds, but market flexibility for others.

I agree with Henry. We need to stop treating this like a political battle and start treating it like a public health problem. The U.S. has the resources, Canada has the coordination. Why not combine the best of both? Maybe a federal price cap on essential generics, with incentives for manufacturers to enter the market? It’s not about left vs. right-it’s about people getting their meds.

My dad’s on 7 different generics. In the U.S., he’s had three shortages in four years. One time, he had to switch to a brand-name version because the generic vanished-cost him $280 a month. In Canada, he’d have gotten a call from Health Canada saying, 'We’re sending you a backup supply.' I’ve seen both systems. The U.S. gives you a price tag. Canada gives you peace of mind. And peace of mind? That’s priceless. 💙

Canada’s system isn’t about being expensive-it’s about being dependable. And in healthcare, dependability isn’t a luxury, it’s the baseline. If you’re choosing between $12 today and $45 tomorrow… you’re not thinking ahead. You’re thinking about your wallet. But what about your future self? What about the next time you’re sick and the pharmacy is empty? That’s when Canada’s system isn’t just smart-it’s lifesaving.